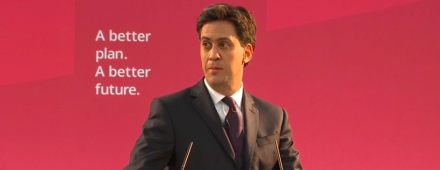

Ed Miliband spoke at Warwick University today, announcing plans to “abolish the non-dom rule”. Here’s the full text of that speech:

It is great to be at Warwick Manufacturing Group.

This is a place where you invent things, make things, train our young people and help our businesses to succeed.

This is in the great traditions of the West Midlands and British industry.

Hard graft.

Honest wealth creation by great businesses.

Inventing, selling, making profits.

Recognising that wealth comes from every worker.

And it speaks to the big choice at this election.

Our view that says:

That it is when working people succeed that Britain succeeds.

Or a different view.

A Conservative view.

The view that wealth only flows from a few at the top, corporations and individuals.

And those few are so important that they can operate under different rules, irrespective of the impact they have.

This is the election choice.

That’s why we need a Labour government.

To put working people first again in our country.

Ask any member of the public, and almost all will say that a very British value is that we should all play by the rules.

Play fair, do the right thing, not take others for a ride.

It is a very British belief in responsibility.

This is a value that runs to our core as a party.

So we say those can work should do so.

And we see that it in our job guarantee for young people and those over 25.

We will guarantee jobs, but people have a responsibility to take them.

Think about our position on immigration too.

We welcome the contribution people make when they come here.

But we believe people should contribute before they claim.

So we won’t give people benefits for at least two years.

We believe responsibilities apply throughout our society.

But are we applying this idea consistently as a country?

Right to the top.

I say we’re not.

We aren’t and haven’t done so for a long time.

And under a Labour government we will make sure responsibility goes right to the top.

So how did we get here as a country?

And how do we change?

It starts with the response to what we saw in the 1970s.

Then, it did appear that wealth creation, profit, and success were being frowned upon in our country.

That was wrong.

And there is no going back there under a Labour government.

We need great companies like JLR, who you serve.

We need businesses, large and small, making profits, wealth and creating jobs.

That is a good thing not a bad thing.

And government can do its bit to help make it happen.

By training all our young people, investing in skills.

Having an effective industrial policy

A decent infrastructure.

And keeping our place in a reformed European Union.

But what we should not do as a country is confuse our correct belief in enterprise and wealth creation and allow it to become distorted into something else.

The view that wealth only flows from a few at the top

And those people should be allowed to operate under different rules.

The idea that “anything goes” for those at the top.

Because what is good for them, is always good for Britain.

The problem is: it isn’t true.

It doesn’t work for most working people.

It doesn’t work for business.

And it doesn’t work for our country.

Take the banking crisis.

We are still paying – you are still paying – the British people are still paying – for what happened because of the global financial crisis.

We were told that the wealth flowed from these institutions, and while it appeared that in bonuses, practices and cultures, there were a different set of rules, that was to our benefit.

And if only the regulation came off, the wealth would magically flow.

For a time, it did.

And then we saw the financial crash.

What the banks called over-regulation turned out to be the dam protecting us from a tide of disaster.

The dam was weakened and it burst.

With all that followed.

Including huge damage to businesses.

We were told it was anti-business to regulate properly.

It wasn’t, it was pro-business.

And while banking is a unique industry because of the impact a crash can have, the need to have fair rules is not just true in banking.

Energy is another market that hasn’t been working.

I called time on it 18 months ago.

The energy companies didn’t like it.

We heard the same dire warnings that we heard from the banks before the financial crisis.

They weren’t right.

They were wrong.

And businesses up and down the country tell me that.

I am in favour of successful energy companies.

Britain needs successful energy companies.

But I am also in favour of an energy market that operates in the public interest.

The same set of rules that other markets follow.

Not special privileges for some.

I want to be clear that I don’t blame either the banks or the energy companies for working with the rules they had.

It’s just the rules weren’t right.

And if it is true in those sectors, it is true too of individuals.

And there is no bigger symbol of this failure to expect people right to the top to play by fair rules than the failure to deal with tax avoidance.

Think about what we now know.

The tax gap between the amount owed and the amount collected has gone up to £34 billion under this government.

Tax havens continuing.

The scandal at HSBC.

The hedge funds given the green light to avoid paying their fair share.

HMRC seeming to operate double-standards.

One law for some big companies, another law for everybody else.

What does this mean?

It means higher taxes for working people and businesses.

As well as starving money from our public services.

If we simply acted on the hedge funds, it would mean over a billion pounds for our NHS.

And that is what a Labour government will do.

In a world of tough, difficult choices, we just can’t allow this tax avoidance to take place.

And it all comes back to the claim that we are powerless in the face of the richest and most powerful.

That it may not be fair to have one rule for them and another rule for everybody else, but that’s just how it is.

But it just isn’t true.

Because governments can act.

The public believe more than ever that they should.

And the next Labour government will put the fight against tax evasion and tax avoidance at the very heart of our mission for our country.

And there is one tax advantage that more than any other has become a symbol of the failure to act.

One that the British people have been aware of for a long time, but where politicians just haven’t caught up.

Non-dom status.

Non-doms means non-domiciled.

But these are people who live here, like you and me, work here, like you and me, are permanently settled here, like you and me, and even were brought up here, like you and me, but just aren’t required to pay taxes like you and me.

They don’t pay UK taxes on the income they receive abroad.

They take advantage of an arcane, 200 year-old loophole.

Believe it or not, it has its origins in colonial settlers who made their fortunes overseas and then wanted to be protected on taxes on the incomes they were receiving in the colonies.

It is time to end all of these years of history.

And let me explain why.

There are now 116,000 non-doms.

It is costing at least hundreds of millions of pounds to our country.

And it cannot be justified.

It makes Britain an offshore tax haven for a few.

And get this:

What is the proof you need to show you are not “domiciled” here?

What are the kinds of test that are applied?

It is fair to say they are not very rigorous.

You can even use the most flimsy evidence to justify your status.

If your father wasn’t born here you can qualify, even if you were.

So old-fashioned are these rules they don’t think it’s even relevant where your mother was born.

But that’s not the only get-out clause.

There are other even weaker criteria.

Whether you own property abroad.

Whether you have a bank account overseas.

Whether you own a burial plot abroad.

And even whether you subscribe to an overseas newspaper.

I want to be clear.

I don’t blame these individuals for taking advantage of non-dom status.

These are after all the rules and they are playing by them.

And you could say more than any other policy, this is a responsibility of governments of all parties.

Over 200 years.

Conservative, Labour, Liberal.

Can I remind you there used to be Liberal Prime Ministers.

And Whig.

By our count, 40 Prime Ministers haven’t acted.

By the way, that doesn’t include Pitt the Younger, who introduced it.

In fact, most other countries think it is bizarre that we continue with a practice that started in the days of the British Empire.

It isn’t right.

Why should people be able to enjoy all the virtues of our great country and not pay tax like everyone else?

Why should there be one rule for some and another for everybody else?

It is not fair.

It is not just.

It holds Britain back.

We will stop it.

The next Labour government will abolish the non-dom rule.

And we will replace it with a clear principle:

Anyone permanently resident in the UK will pay tax in the same way.

The rules we will introduce are modelled on what other countries do.

Real temporary residents, here for a brief period, will only have to pay tax on what they earn here

Because they will be paying their taxes in their place of permanent residence.

But everyone else will have to pay tax on their worldwide income.

Now, some people will say that if we change the rules people will leave the country.

Just like they used to say that we can’t act on bank regulation because the banks will leave the country.

That we can’t act on energy companies, because the big six won’t stand it.

Some of them are the same people who said back in 1997, that we shouldn’t introduce a minimum wage because it would cost millions of jobs.

Some even threatened to leave back then.

And guess what?

They’re still here.

It is the same outdated idea whose time has gone.

I just don’t believe the way we compete in the world is as an offshore tax haven.

We don’t compete in the world by offering tax advantages that we don’t give to all our own citizens.

It is not fair on all those millions of businesses who pay their share and play by the rules.

It is not fair on all the people who rely on our public services.

And with a deficit to pay down, the country can’t afford it either.

And there is a moral reason for it too.

We all use the same roads.

We are all protected by our police and armed forces.

Even those who go private, often rely on the NHS.

It is what I call the common good.

We use these same services therefore we all owe obligations to help fund them according to our ability to do so.

It is what makes our country strong.

It is what will allow our country to succeed.

I believe that most people will agree that it is time for a crackdown on tax avoidance.

They will agree that we cannot carry on acting as an offshore tax haven for a few.

The question you have to ask in the next month is who will make it happen.

I do not believe it will ever happen with David Cameron and George Osborne.

All we get is excuses for failure to act from them.

The same excuses they have wheeled out for failing to act on tax avoidance through this parliament when the tax gap has widened by billions.

This morning, they have been advancing a whole set of separate and totally contradictory arguments.

That our proposals are: catastrophic because people will leave the country, cosmetic because they are not a big enough change and unnecessary because it is happening anyway.

They can’t make up their mind.

But my challenge to the Prime Minister and Chancellor is simple: stop defending the indefensible and abolish non-dom status.

They won’t act.

And we know that because of their record of failure, by the people who fund their party, but above all because of what they believe, they will never act.

Because they believe in the old idea that as long as the rich and powerful are OK then everyone else will succeed.

They may be strong when it comes to standing up to the weak, but always weak when it comes to standing up to the strong.

Britain doesn’t need a government which is the political wing of the off-shore tax avoidance industry.

We’ve tried their way over the last five years and it has failed.

Another five years means another five years of lower living standards, falling wages, insecure jobs.

And all the time, people being ripped off by the powerful interests.

And the taxpayer being ripped off by tax avoidance.

Starving money from our public services

Increasing the burden on working families to pay down the deficit.

Britain will only succeed when working families succeed.

That is the only way forward for our country.

There is only one party that can achieve it.

That’s why we need a Labour government.

More from LabourList

Letters to the Editor – week ending 1 March 2026

‘I spent years telling workers the law couldn’t help them – that has changed’

Josh Simons resigns as Cabinet Office minister amid investigation