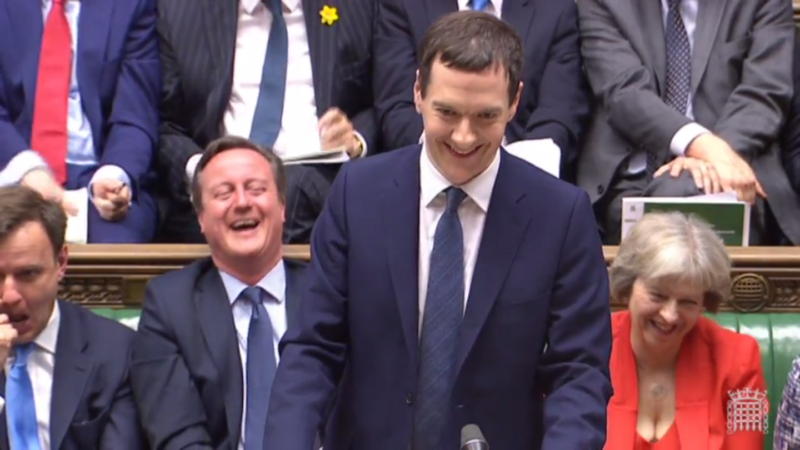

It has been 24 hours since George Osborne delivered his eighth Budget – a typical Tory package of austerity that will hit the poorest hardest. The reality is buried in the small print so we have combed through the documents for you.

1. George Osborne has paid for tax cuts for the wealthy by taking money from disabled people

Osborne cut £4.4bn from the Personal Independence Payments, which go to the disabled and those with chronic health problems. Some 370,000 disabled people will lose an average of £3,500 a year. Osborne will take £590m PIPs next year to fund a £630m cut in the rate of capital gains tax.

2. Osborne has missed two of his three fiscal targets

The Chancellor failed to begin the turnaround when debt as a share of GDP begins to fall, one of the three rules he set for himself.

This weakens the underlying health of the economy and stifles the potential for growth, hitting Government tax receipts. The level of debt-to-GDP ballooned after the financial crisis and has continued to rise under Osborne.

Osborne also failed to meet his welfare cap. While this is a political embarrassment for Osborne, it is not a goal many Labour members supported.

He still claims to be on course to run a £10.4bn surplus by 2020 – even though the IFS has said there is only a 50:50 chance of simply balancing the books. As Paul Johnson, director of the IFS said today, Osborne is running out of “wriggle room”. If the “cocktail of threats” identified by Osborne were to materialise then he could fail to meet this surplus target too.

3. He is persisting with the “tampon tax”

The Chancellor finally named the women’s groups who will receive money from the tampon tax – the levy on women’s sanitary products because they are classed as “luxuries” under EU rules on VAT.

However, women’s charities are in a far worse position than before the Tories got into power. One in six domestic violence refuges have closed between 2010 and 2015. Women’s services are funded from local government grants but cuts to local governments have threatened these. In fact, 95 per cent of charities involved in tackling violence against women are in financial danger.

4. He still has no idea of the ultimate cost of Universal Credit

The cost of finally rolling out Iain Duncan Smith’s chaotic welfare reform is one of the “largest sources of uncertainty” in the Budget, according to the Office for Budget Responsibility. IDS’ department needs to complete changes to six other benefits before the cost of Universal Credit can be confirmed.

5. There is a £560m black hole in Tory plans to convert all state schools to academies

Forcing schools to become academies costs an average of £45,000 per school. The meagre £140m which has been set aside for this is forecast to lead to a £560m shortfall in schools funding. Without any explanation in the Budget of where this money will come from, it is likely the Chancellor will raid other areas of public spending before 2020.

6. The Lifetime ISA is “more likely than not” to make it harder for young people to buy a home

The new ISA to encourage young people to save for a first home or their retirement is unlikely to provide any help for homebuyers, the OBR has said. It also risks pushing up prices by increasing demand for housing without doing anything to tackle supply, at a time when construction of ordinary and of affordable housing is running at chronically low levels.

More from LabourList

Josh Simons resigns as Cabinet Office minister amid investigation

‘After years of cuts, Labour’s local government settlement begins to put things right’

‘The Sherriff of Wild Westminster: what must change in elections bill’