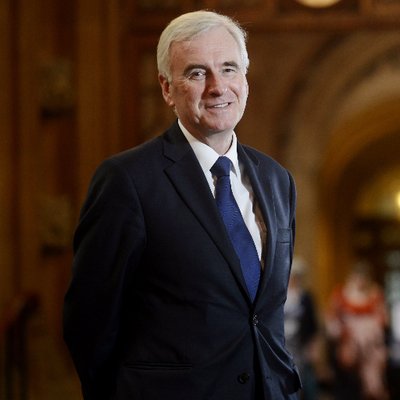

This is the full text of Shadow Chancellor John McDonnell’s speech at Bloomberg’s new European headquarters today, in which he sets out a “new start” for the City.

Let me start by thanking you all for coming today and by thanking Bloomberg for the use of their magnificent new building here in the heart of the City.

Since Jeremy appointed me as Shadow Chancellor three years ago I’ve been touring the City meeting representatives from across the finance sector, asset managers, banks and investors.

Actually it’s nothing new to me because when I was a youngster and chair of Finance on the GLC, effectively the Chancellor of the Exchequer for London, that’s exactly what I would do on a regular basis and established a good working relationship.

For the people I have been meeting over the last two years, if they are readers of some of our more excitable newspapers they expect to be meeting a raving extremist who is about to nationalise their company and send them on a re-education course somewhere up north.

Mind you, Mark Carney quoting Marx and Engels the other week has thrown the Daily Mail and others into complete confusion.

I’ve been meeting all these people to explain Labour’s plans and to discuss the important role I want the Finance Sector to play in the transformative programme of the next Labour Government.

At each of those meetings I’ve said the same thing as I will say to you today. We are completely open and transparent about our plans. There are some policies that you will like and some of which you will be less enthusiastic about.

I don’t expect some people to be overjoyed at having to pay a bit more in income tax or corporation tax or at the introduction of a Financial Transaction Tax.

But most people recognise with us the need for large scale investment in both our infrastructure and new technology and also in human capital with investment to raise standards in our education system, training and research and development.

And most people agree that a civilised society needs a foundation bedrock of excellent public services.

The key for me is that you become aware of what we intend to do not by rumour or scaremongering by some in the media but by direct engagement and discussion with us.

Two things you need to be clear about. First, there are no tricks up my sleeve. What you see is what you get.

Second, when we go into government, we want you to come with us, alongside representatives from our manufacturers, our trade unions and wider civil society. There will be a seat at the policy making and policy delivery table for you.

That’s the tone I have tried to engender at the many meetings I have had in the City. By the end of these meetings we have found that we are generally on the same page. The participants sometimes are a little surprised when I get carried away and end the meeting by saying “Thank you comrades.”

So I’ve convened today’s conference for this reason. The need for an absolutely straight conversation between Labour and the City on three things:

- What we as the Labour Party are about

- What we want from you,

- And what we as a government will offer you in return.

I would like today to be an important next step in our dialogue. Today’s discussions will inform the development of our programme in opposition. And help guide its implementation as we go into office.

Jeremy Corbyn became leader of the Labour Party because thousands were inspired by his vision.

It’s a vision I share: a vision of a society that is radically transformed, radically fairer, more equal and more democratic.

A vision of a society based upon a prosperous economy, but an economy that’s economically and environmentally sustainable, and where that prosperity is shared by all. I know many of you share our vision of a better society.

But some may question whether a fairer, more equal society is compatible with the growth and prosperity which is needed to underpin it. I say that those two things aren’t just compatible: they are essentially complementary.

We can deliver those twin goals but it will mean a new relationship between Labour in government, and the finance sector.

What we want from the finance sector.

The next Labour government will be a radical, progressive, intervening government. Building a high investment, high wage economy will require effective government willing to take a lead.

The lesson of recent decades – including the global financial crisis – has been that a “hands off” approach will not deliver the sustainable, broad-based growth which we need and expect.

In the last few years, the prevailing economic orthodoxy has led to wages lower today than they were eight years ago, and the slowest decade of productivity growth since the Napoleonic Wars.

Though there were clearly other factors, few people now dispute that these economic failures contributed to the vote for Brexit in 2016.

In our manifesto last year we said how we would break with the failed austerity policies of the recent past. Doing so within the constraints of our Fiscal Credibility Rule clearly means raising greater revenue from taxation.

We said that we will institute a small Financial Transactions Tax, with benefits in terms of financial stability as well as raising much-needed revenue. Avinash Persaud, whose work inspired our proposals, will be speaking later.

But Labour’s manifesto went beyond raising tax revenue in order to support our struggling public services.

We made it clear that Labour in government will intervene to shape the economy, and that willingness to intervene naturally includes the financial sector.

We published detailed proposals from independent experts – including Ozlem Onaran – for our National Investment Bank and network of regional development banks, to support small and medium-sized businesses and direct economic growth.

Those institutions will be independent of government but mandated to support the government’s policies, and will work with the rest of the finance sector to do s.

Entrepreneurs and financiers alike have spoken to me since then about the difference a National Investment Bank could make, and the appetite for it across the country.

Building on our proposals for a National Investment Bank, in September I committed to setting up a Strategic Investment Board with the goal of increasing and directing investment in the UK economy.

Bringing together Chancellor, Secretary of State for Business and Governor of the Bank of England, the SIB will use the most detailed and up-to-date data available to promote investment and wage growth.

Building on this, I asked GFC Economics to report on the financing of productive investment in the UK and to make policy recommendations.

In December, GFC published their interim report, which you will hear Graham Turner discuss this afternoon.

That report detailed the shockingly low rates of investment in the UK, and detailed how unprepared much of our economy is for the fourth industrial revolution.

There are huge uncertainties about how this technological change will play out, with global forecasts ranging from 800 million new jobs created, to 800 million jobs lost over the next few decades.

We can see some impacts already but the UK is behind other economies in the use of new technology and has the lowest rate of industrial robot usage of any OECD country.

This is hardly surprising when Britain currently takes deposits from manufacturing and technology industries, and lends them to the real estate sector.

If the possibilities of the fourth industrial revolution are to be realised, we will need the financing and financing skills in place to achieve it.

To support this, GFC recommended both new structures and moving some of the functions of the Bank of England to Birmingham, with new offices to be established elsewhere around the UK.

I will receive their final report in the next few months, which will include further recommendations on reform, including to the Bank of England. Of course, our proposals for reform will never find favour with absolutely everyone.

I make no apology for believing in the need for finance to serve the wider economy rather than becoming the over-powerful master of everything else. There have always been many people in the finance sector who understand and share that belief.

I’ve been heartened by the number of people from financial institutions who have wanted to know about and help develop our industrial strategy. And I hope many of you will see the opportunities that our reform proposals bring.

Let me turn now to Labour’s offer of what we in Government can offer the finance sector in return.

We will provide a stable policy environment based upon long term policy making and patient, long-term investment directed in line with clearly defined policy objectives.

This will be underpinned by our commitment to drive up productivity, economic growth and living standards.

Labour in government will provide the large scale funding needed to equip Britain to meet the challenges of the fourth industrial revolution.

We will radically modernise our ailing infrastructure, invest in R&D and new technology and support our growth industries.

All of this will provide the opportunity for you to work with Labour in government to create the prosperous economy we all want to see.

You will have the opportunity to share in the rewards of that long term investment and can expect a stable return for doing so.

We will ensure those stable conditions by entering into a new relationship to ensure that we rise together to meet the three major challenges facing this sector and the wider economy.

The challenges of Brexit, accelerating technological change and climate change.

Let’s start with the immediate issue of Brexit. The challenges for British finance are clear, and Labour has been resolutely clear in approaching them.

Within a fortnight of the vote to Leave the European Union, I laid down our five “red lines” for the future negotiations and the eventual deal. Critical amongst them was the retention of market access for the UK’s financial services.

The right for our financial service companies to win business across Europe, and the reciprocal right for European companies to win business here, remains essential

We respect the result of the referendum, and we want the best possible deal for Britain as we leave the EU.

That means a deal that protects jobs, living standards, and the broader economy as a priority – not one designed around arbitrary targets on migration.

So we don’t want to be held back by the terms of a deal in supporting new industries here, or providing for stronger environmental and workplace protections than the EU can presently offer.

We have called since the election for a stable transitional period that preserves the existing Customs Union and Single Market arrangements.

And we will seek a final deal that gives full access to European markets and maintains the benefits of the single market and the customs union, with no new impediments to trade and no reduction in rights, standards and protections.

I’ve been concerned to read this week that a barebones deal for our finance sector is now being considered by the EU.

This is happening because we have a government that places appeasing hardline Brexiteers above winning the best possible deal for this country.

Labour wants a close future partnership with Europe. That partnership can best be forged if we change the tone of the current negotiations to one based upon mutual respect and mutual interest.

Looking beyond the looming threat of a mishandled Brexit, the pace of technological change poses longer term but equally significant challenges to financial services.

There’s no doubt that the impact of Big Data and AI for the existing banks could be substantial.

The Bank of England’s last set of stress tests estimated that existing banks could take a £1bn hit to their profits as a result of fintech innovation. But that is only a relatively short-term consequence.

The longer-term impact for the sector and for society more generally could be far wider. Mark Carney has suggested that existing banks could shift to become something more like utilities companies – largely unseen by customers, but providing an essential service.

The potential gains for all sides – the sector and consumers – will only be realised, however, with effective governance and regulation.

Perhaps the greatest single lesson of the last decade in finance is that deregulation of complex and essential activities like financial services will not lead to the best result for society.

That the market, left to its own devices, will not always produce the best possible outcome.

So there is a need today, highlighted by campaigners and experts alike, in addition to developing effective regulation, we also need to build in government support for new finance business models that put social purpose at their centre.

The potential for large tech firms to move into the banking sector is now very real. With their better data know how tech companies are slowly engaging in the banking sector. Amazon already offers loans to small businesses. Ant Financial, using its ties to Alibaba now has 450 million users of its banking and payments system.

So the change is happening and the combination of big data and finance will force new kinds of ethical questions for regulators, businesses and wider society alike. Insights derived from big data and Artificial Intelligence, by their very nature, depend on exceptionally complex decision-making processes.

Alongside the gains for efficiency and the creation of new financial products, the new forms of systemic risk associated with Artificial Intelligence and machine learning in finance have been highlighted by the Financial Stability Board.

So we will work alongside you, yes in developing the regulation but in forging the new relationship with finance that will ultimately be needed secure the public’s confidence.

Finally, let me turn to our single greatest challenge, climate change.

This is leading to specific difficulties in our financial services, from the rising costs faced by insurers confronted with increasingly extreme weather, to the costs of moving out of investments in carbon-heavy industry.

The uncertainties are immense – one estimate of the value-at-risk from climate change has put the range at between 4 and 43 trillion dollars worldwide.

It is heartening that many financial institutions have signed up to the recommendations of the Taskforce on Climate-related Financial Disclosures, but concerning major financial institutions globally failing to do enough, with half lacking clear strategies to cope.

The lead taken by the Bank of England here has been welcome. But to manage this challenge requires real leadership from government – not abdicating responsibility on the environment, as this one has.

We recognise the huge risks climate change poses for our economy and to financial services specifically. The next Labour government will take an active lead in managing the economic risks of climate change.

We have already announced we will mandate the Office for Budget Responsibility to report on the long-term impacts of climate change on the government’s fiscal position, placing climate change at the centre of our economic decision making.

Sustainable investment will be at the heart of our programme for government and we will work with you to support and develop innovative new funding mechanisms for low-carbon technologies.

I have appointed Clive Lewis MP to my team to lead on environmental economics. His task is to drive the climate change issue into the heart of Treasury policy making and therefore at the centre of government.

Representatives of the finance sector will be invited to join Clive in the country wide policy tour he will be launching shortly.

So let me reiterate Labour’s central message to you today.

First we recognise the important role the finance sector must play in the transformative programme of the next Labour Government.

Second we commit to working with you as we develop our programme in opposition and implement it in government.

Third we will always be straight with you about our objectives and our intentions.

Fourth we pledge to work with you to overcome the challenges we as an economy and as a society face together starting with a Brexit deal which puts jobs and the economy first, rising to the challenge of fast paced technological change and addressing the threat of climate change.

What we are offering is a new start in the relationship between Labour and the finance sector. A relationship in which we recognise the potential of a transformed British financial system, at the leading edge of technology, fulfilling a clear, socially necessary role.

Labour will not just rebuild our economy after the damage almost a decade of austerity but we will modernise it.

And you in the City will not only get a good return from the investment you will make in our programme but what we will also deliver for you is a society you can be proud to live in and will provide the quality of life your families desire.

Together we will enable an economic and social transformation of our society that you will be proud to have contributed to.

We know, just as you do, that the only way we can achieve that change, is if we do it together.

So that when we go into government we go in together.

Thank you.

More from LabourList

Delivering in Government: your weekly round up of good news Labour stories

‘Outflanked on both sides: why Labour is losing touch with the economy’

‘Labour’s lesson from Denmark: immigration alone won’t save you’