Yesterday the Chancellor engaged in the usual pre-budget charade of touring the Sunday studios trying to drum up expectations for the budget by saying absolutely nothing of significance. But one thing really stood out. Jeremy Hunt claimed that this “will be a prudent and responsible” budget, but all the expected policies say otherwise.

All signs suggest Hunt will put politics over prudence

If the rumour-mill is to be believed the Chancellor is about to announce a starkly political budget – perhaps the most political we’ve seen in many years. The motivation is clear. It’s not prudence and responsibility, but a desire to put a Labour opposition in a difficult political position, whilst further undermining the economic recovery of Great Britain.

The economic backdrop to this budget is lamentable – the British economy is weak and is suffering from mismanagement. Inflation remains higher than other economies while our growth is lower. A deeper look at the news that the UK fell into a technical recession at the end of last year shows our economy is not shrinking drastically nor booming either. The UK economy is stagnating, not going anywhere, with growth bouncing around zero.

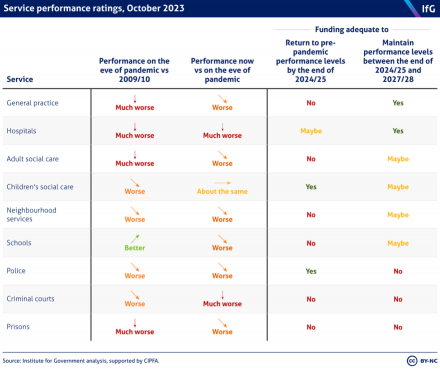

A weak economy has translated into crumbling public services. The Institute for Government’s Performance Tracker shows that of the nine public services they looked into, only two will be operating at their pre-pandemic level by the end of 2024/5 and only another two have funding in place to maintain their current (already poor) performance until 2027/8.

If all the pre-briefings to newspapers are to be believed, what is the Chancellor’s answer to this?

Well, it will be to cut taxes on income paid for with some more cuts to spending after the coming general election when all the forecasts say this will be someone else’s problem. He also plans to support public services by, erm, further cutting their budgets and finding further efficiency savings that no over-stretched public servant has managed to identify during the last 13 years of cuts.

Tax plans could spell further cuts for public services

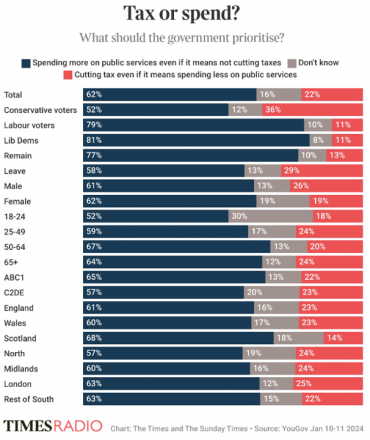

Let’s be clear. This is neither fiscally responsible, nor is it prudent. It’s not responsible to say that you can spend money today without being clear about where it will come from, but that’s exactly what the government are doing. What’s more? This is blindingly obvious to anyone who exists in the real world where people have to try and find a rarely-spotted NHS dentist. Recent polling has showed that across almost every segment of society, the public would rather spend more, not less, on public services even if it means keeping taxes where they are today.

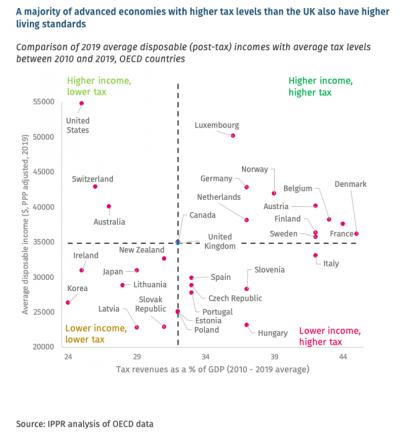

On the Sunday shows, Hunt talked up the need for tax cuts by telling viewers that the countries that tend to have faster growing economies tend also to have lower taxes. While this might be the case, GDP doesn’t tell us everything about how the economy is doing. Especially after a cost-of-living crisis, household incomes matter too. But if we switch from looking at how fast economic output is growing to how fast household incomes are growing then the picture is very different.

Low tax economies don’t benefit working people

Recent IPPR research showed that most advanced economies that have lower taxes than the UK also have lower incomes. Most of the countries with higher levels of tax than the UK also have higher levels of income. Put another way, low tax economies might be faster growing but that’s not benefiting working people. This shouldn’t be a surprise, higher levels of tax mean more public investment and more spending on public services, the lack of these things is exactly what is holding the UK back today.

Another development has been the rumour that Hunt will scrap the non-dom tax loophole, something he didn’t deny this weekend. As I wrote last week, if the chancellor does close this unfair loophole, he will really be putting the lie to all the discourse on taxes in the mainstream media today. He will prove that there are fair ways of reforming tax that raise revenues – and yes, raise levels of tax as a % of GDP too – but that don’t hit normal, working people one bit.

A non-dom shaped headache for Labour?

Arguably, scrapping the non-dom tax regime is most attractive to the chancellor now because it creates a headache for Labour. He has previously criticised the Labour party for committing to doing the same. At the time Labour allocated the revenue it would raise from closing the loophole to two areas: an increase in spending on the NHS, and breakfast clubs for schools. These are popular economic and social policies that distinguish Labour from the government and that polling shows voters are crying out for, rather than tax cuts they don’t want.

Neither would be easy for Labour to ditch but if the government does close the loophole and uses the additional revenue elsewhere, the party will have to look for other ways to raise it. But this would create a dividing line between the parties on tax, something Labour have been trying to avoid at all costs. And it would be a dividing line on priorities – it would show Labour willing to increase the taxes on the wealthy but, in line with public opinion, that they would use it to give public services a much-needed boost.

The question for Labour this week is how far are they willing to follow the Conservatives down a tax-cut-doom-spiral, ditching future public services and investment that the electorate are crying out for, in favour of tax cuts they’re not? The evidence is strong. Tax cuts paid for by future cuts isn’t fiscally responsible, it won’t fix our economic problems, nor is it in the national interest, and voters know it.

More from LabourList

Delivering in Government: your weekly round up of good news Labour stories

‘Outflanked on both sides: why Labour is losing touch with the economy’

‘Labour’s lesson from Denmark: immigration alone won’t save you’