Housing is going to be key to Labour’s offer in 2015. Most of the debate so far though has been to talk about the need to build more homes.

But could Labour be about to come out for rent capping/rent controls?

At Fabian Conference this afternoon, Shadow London Minister Sadiq Khan praised plans for a rent cap and suggested that it’s something he’d support Labour doing. As well as being in the Shadow Cabinet, Khan is close to Ed Miliband – he ran his 2010 leadership campaign.

Rent controls aren’t currently Labour policy – but it’s unlikely Khan would have endorsed this without speaking to Miliband first.

Should we expect Labour to come out for rent controls? It’d certainly be consistent with a Milibandite “predistribution”/market-intervention approach by tackling costs…

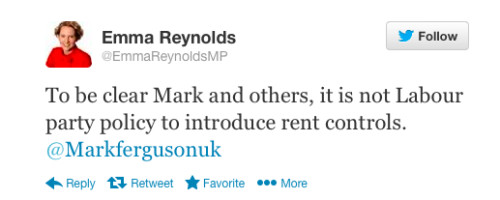

Update: Quick as a flash, Shadow Housing Minister Emma Reynolds tweets to say that rent capping is NOT Labour policy. So it seems Khan has been off script here. Here’s what Reynolds had to say on the matter:

Yet eagle-eyed Jessica Asato notes that Ken Livingstone advocated a “London Living Rent” back at the last Mayoral election. So is this perhaps a policy endorsed in London only? It’s not clear…

(Incidentally, in a vote at Fabian Conference, rent capping was by far the most popular policy in their “Dragons Den” debate)

More from LabourList

A year in power: The cabinet on their proudest wins and favourite moments

‘One year on, Labour still hasn’t reckoned with collapsing trust in politics’

‘I’m the Labour MP who beat Liz Truss. Here’s how the campaign to unseat her unfolded’