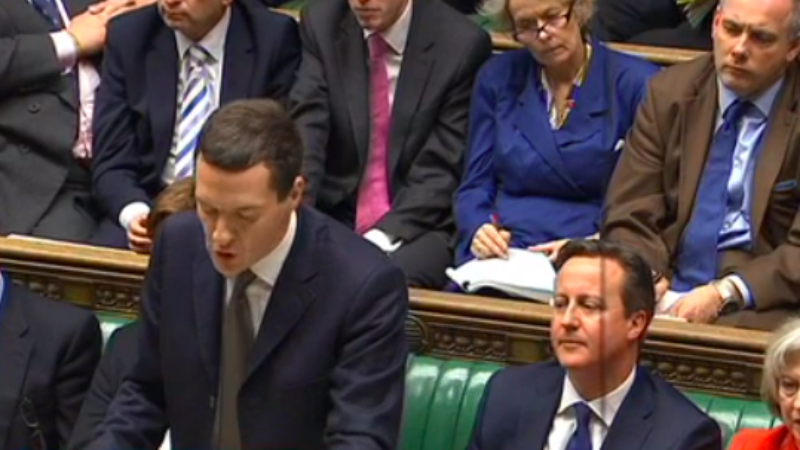

My plan for this week’s column was “pick something you hate about the Budget and write about it.” Lamentably (and entirely predictably) there was quite a lot to hate about the Budget, so choosing just one thing was always going to be tough. Should I talk about the way Osborne boasted about poverty falling, neglecting the fact that this is only because poverty is measured against median incomes which are also falling? Should I bring up the fact that he implied lower living costs were a result of Tory policy, rather than global deflation and falling oil prices? Or should I mention the sheer eye-watering chutzpah of his claim that young people are better under the Tories?

No. Let a commentator more patient than I tackle those issues. I want to talk about tax, because one of the centrepieces of the Budget was the Chancellor’s suggestion that he has improved the tax system for ordinary people. It’s a peculiar brand of Tory fairness that seems to go thusly: “we’ve reduced fuel duty for ordinary people, so you won’t mind if we just knock a few thousand quid off the tax bills of our millionaire mates, will you?”

This week Class released an election guide on the subject of tax, which contains some very interesting statistics. And here’s my favourite: since 2010, the coalition has raised taxes for ordinary people at least 24 times while cutting taxes for the rich and for corporations. That statistic alone should blow any claim of a progressive tax system out of the water, but let’s not stop there. There’s also the highly dubious explanation Osborne gave for cutting corporation tax – that a “competitive tax system” is good for the economy.

That’s interesting, because it’s not what Warren Buffet thinks. He says: “I have worked with investors for 60 years and I have yet to see anyone – not even when capital gains rates were 39.9% in 1976-77 – shy away from a sensible investment because of the tax rate on the potential gain.” And it’s not what the evidence shows: cutting taxes on corporations is not good for the economy as a whole, because you have to make up the shortfall somewhere; and where does that usually happen? From the pockets of ordinary folk who can’t afford fancy accountants of course. In any case, France, Germany and the USA – to name but three – all have higher corporation tax rates than the UK. It’s not as though we are wildly out of step with the rest of the world.

Finally, Osborne – and later, Danny Alexander – made a big song and dance about raising the personal tax allowance, i.e. the threshold before which you have to start paying tax on your income. For Osborne this seemed to be definitive evidence of his government’s determination to give ordinary people a break. But as the Equality Trust puts it, “As analysis after analysis has shown, increasing the personal tax allowance does not help families on the lowest incomes at all and helps those on higher incomes more than those in the bottom half.” To paraphrase a tweet from Guardian leader writer Tom Clarke yesterday: “Those “tax cuts for low earners” in full: people earning less than £10.5k get nothing; people earning less than £43k get £120; people earning more than £43k get £220.” Clarke later conceded that once we get into six-figure salaries, there is no benefit from the higher allowance – but this is hardly a progressive move. Ultimately raising the personal tax allowance has to go hand-in-hand with cutting taxes on the rich if it is to have a role in a redistributive tax system.

Not to worry though: in 50 years ‘ time we’ll all be so worried about climate change, we won’t be thinking about the tax system. Osborne didn’t mention that either – except for offering tax breaks to oil companies, of course.

More from LabourList

‘The cost of living crisis is still Britain’s defining political challenge’

‘Nurses are finally getting the recognition they deserve’

Letters to the Editor – week ending 15th February 2026