George Osborne gave his Autumn Statement today where he announced that alongside stamp duty reforms that the Government will freeze Universal Credit work allowances for a further year and cut tax credits when overpayments are certain.

But what impact will these changes have? Osborne’s own Government have produced stats which show that the forecast isn’t good for the lowest earners.

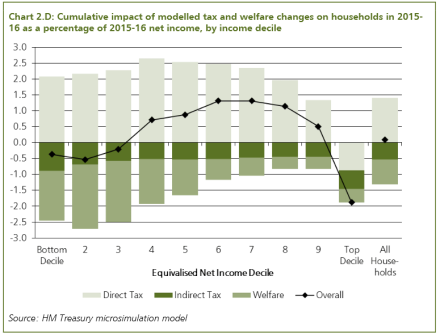

The following graph was produced by the Treasury and shows that low income households stand to lose far more through indirect tax and welfare changes than they gain through direct tax changes.

Middle income households (in the 4th, 5th and 6th decile) do slightly better, gaining more than they lose through Osborne’s proposals. But the further you progress up the income ladder, the more you stand to gain (excluding the top 10%). Those in the 8th and 9th decile do the best under the Tories proposed changes – by a significant amount, particularly if you compare this with the lowest earner (1st, 2nd and 3rd decile):

The changes that Osborne announced today just show that the Tories are intent on continuing to hit the poorest the hardest.

More from LabourList

‘Turning public services around: Haringey’s story of child protection’

‘Can Labour turn the green tide back to red?’

Tom Belger column: ‘Why is Labour making migrant exploitation easier?’