We are now eight years on from the banking crisis that brought the financial services sector to its knees and saw ‘too big to fail’ banks bailed out by the state. Eight years later and bankers’ behaviour and their bonuses remain in the news, court cases continue, hundreds of millions of pounds of necessary fines on institutions have been issued since 2010 and – despite a series of commissions and reviews – there remains too little evidence that the lessons of the banking crisis have been learned.

But despite public anger with top bankers – not least from those customers who lined up at cash machines to withdraw money from Northern Rock in 2008 – the Conservative Chancellor has cunningly turned a banking sector crisis into a public spending crisis. Cuts for vital services seemingly have no end in sight and now thinks he can now turn back the clock in the banking sector.

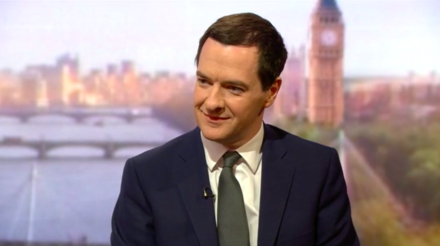

Under George Osborne things are going in the wrong direction. He has sold off shares in RBS at a very significant loss to the taxpayer. He decided he could do without the continued services of the Chief Executive of the Financial Conduct Authority, Martin Wheatley. And the FCA’s planned public review into Banking Culture has since been cancelled and its investigation into the promotion of tax evasion by HSBC has been brought to a premature conclusion.

And now we have the Bank of England and Financial Services Bill, originally drafted – according to the Chancellor – to make changed to the Bank of England’s structure. However, in the second half, the Bill contains a major change to the regulation of senior bankers, undoing a key measure taken after the banking crisis in order to attempt to change senior bankers’ conduct and deliver transparency and accountability in financial decision-making – the presumption of responsibility or so-called ‘reverse burden of proof’.

The presumption of responsibility applies to senior managers and means that where there has been a regulatory contravention in an area for which they are responsible, in order to avoid being found guilty of misconduct, they will have to prove that they took reasonable steps to prevent that contravention.

The policy was introduced with cross-party support. It was originally proposed by the Parliamentary Commission on Banking Standards – led by the Conservative MP Andrew Tyrie and Labour’s Lord John McFall. And the Liberal Democrat’s Lord Newby – a Conservative – Liberal Democrat Coalition Government Minister – moved its introduction into law.

Passed as recently as December 2013, the presumption of responsibility has yet to come into effect and remains untested (its due start date is March 2016 – just a few weeks away). Why George Osborne has decided to make this dramatic change now remains a matter of debate but even Conservative MP and Treasury Committee member Mark Garnier has enquired about lobbying of the Chancellor.

Indeed Andrew Tyrie put it very well in October, when he asked the Chancellor “Why did you not wait for the regime to come into force, to enable an assessment of it how it works to be made, before implementing this further change?”.

This is a very serious question. Banks may be having to put significant effort into identifying and establishing new procedures to meet the requirements of the Bill, but in 2013 when the Bill was supported on a cross-party basis in Parliament, this was already clear. Now the Conservative Government has dramatically ‘u-turned’ and is not willing to even test the procedures it supported in the first place.

Labour believes we need a thriving, responsible and properly regulated banking sector that serves the interests of the whole economy, doesn’t let down ordinary people or small and medium sized businesses and delivers vital investment the country needs for long-term growth.

Labour believes that a Conservative Government climb down on the presumption of responsibility George Osborne previously supported will hinder, not help, this ambition. Scrapping a key measure before it has even had the chance to be tested doesn’t make any sense – unless the Chancellor is just following Bankers’ orders.

Scrapping the presumption of responsibility – and so quickly – shows that there is a very real risk of failing to learn the lessons of the banking crisis. That is why we are asking the Government to think again today.

Richard Burgon MP is Shadow Economic Secretary to the Treasury

More from LabourList

‘Farage lost and blamed Muslims. The data doesn’t support his suspicion’

‘Is the Co-operative Party the key to recovering Labour’s lost young voters?’

Scottish Labour candidates say voters are ready for change – and that the polls may be wrong