George Osborne is giving away an average of £3,000 to some of Britain’s richest people under his flagship Budget measure to slash capital gains tax (CGT), Labour said today.

Some 200,000 people, or 0.3 per cent of Britons, are set to benefit from the tax cut, in comparison with the average hit of £3,000 or more on disabled people through the Chancellor’s plans to reduce disability support for 300,000 people, according to figures published by the Opposition. Osborne was later forced to perform a u-turn on the cuts to Personal Independence Payments as Iain Duncan Smith quit the Cabinet and savaged the Budget as “deeply unfair”.

Today Labour called on the Tories to also drop the cut to CGT and painted the Chancellor as in hock to City traders.

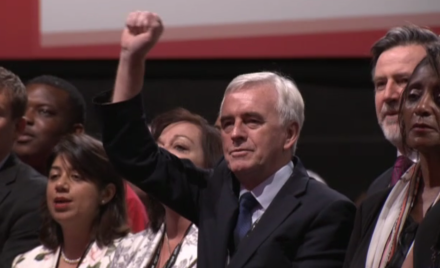

“These figures show the priorities of George Osborne, he planned to fund this £3,000 giveaway to 0.3 per cent of the population by taking over £3,000 from hundreds of thousands of disabled people,” said John McDonnell, the shadow Chancellor.

“When you consider the small number who benefit from this tax cut or that the pattern of taxable receipts from capital gains tax come from those who trade in financial assets, it blows apart any claim the Tories make about ‘we are all in it together’.

“This crass tax cut should not be going ahead, because we need an economy that works for the many not tax cuts for the few.”

Osborne used the Budget to cut the higher rate of CGT from 28 per cent to 20 per cent and lower the basic rate from 18 per cent to 10 per cent.

Each individual has an allowance of £11,100 before they have to pay the tax on the profits from a second home, business or shares.

Around 200,000 people paid CGT in 2014 but the average gains cover a vast range of lifestyles from affluent pensioners renting out a second home to that of the super-rich. Some 5,000 taxpayers sold-off taxable assets worth up to and above £1m.

More from LabourList

MPs, union leaders and organisations react to ‘bruising’ Gorton and Denton result

A gory night for Labour

‘SEND reforms are a crucial test of the opportunity mission’