Phillip Hammond’s u-turn on the £2bn national insurance contributions (NICs) hike for the self-employed will be a relief to the low- and middle-earners threatened by an unfair tax rise that broke a Conservative manifesto promise. But it represents a complete humiliation for the chancellor himself, whose reputation lies in tatters barely a week after his first Budget.

Labour immediately opposed the tax hike, with Jeremy Corbyn making our opposition clear in his response straight after the Budget speech. Our frontbench team and backbenchers drove the message home over the days following, and we were joined by a business organisations including the Federation of Small Businesses, and a number of trade unions.

The government’s initial attempts to define the tax as a “fair” – in the prime minister’s words – measure that would really hit only the very wealthy were blown out of the water. The campaign against the measure boxed the Treasury in, and by the time opposition could be heard from all sides of the House – including Tory backbenchers – the pressure proved too much. With relations between the Treasury and Number 10 already sour, the chancellor was pushed into his u-turn.

This is the third major Budget u-turn by the Tories since Jeremy Corbyn became leader of the Labour Party. Tax credit cuts imposed in the summer 2015 Budget were reversed, after Labour opposed them, in the 2015 Autumn Statement. Cuts to personal independence payments in Budget 2016 were reversed, after Labour opposed them, by the weekend following. And now the unfair self-employed NICs tax hike has been reversed barely a week after it was announced. This Tory government has a tiny minority, is riven with divisions, and is susceptible to pressure. But that pressure needs to be applied. Under Jeremy Corbyn it has been, because Labour’s economic policy is now very clear: we oppose spending cuts and we support a fair tax system.

We should be under no illusions that the tax hike was a progressive or reasonable measure. First, it was a clear break of a manifesto commitment. People vote for parties in the expectation that what they say during the campaign they will stick to in office. Breaking that trust is damaging for democracy in general. Second, it meant all those earning a little more than £8,000 would be paying more tax. With average earnings for the self-employed already falling steeply – average self-employed pay is now just £12,000 – this cannot be considered a fair move. The government was asking people already scraping by to pay more. A hairdresser on the typical salary of £15,000 would have been £137 worse off as a result. Third, this tax hike on the self-employed – the majority of whom are low- and middle- earners – was to be imposed at the same time as the government was continuing with cuts worth £70bn to taxes paid by the super-rich and giant corporations.

There’s a critical point here. We shouldn’t accept the idea that redistribution from those workers and business owners slightly up the income scale to those slightly lower down is acceptable. It isn’t. It is the super-rich – not just the 1 per cent, but the 0.1 per cent, those earning over £1m – and the giant corporations that must be targeted. Yet the current government, whilst imposing the worst spending cuts for generations on our public services, has continued to hack away at the taxes paid by precisely these people. That is the Tories’ political choice: spending cuts for the majority, tax cuts for the elite. Labour will make different choices.

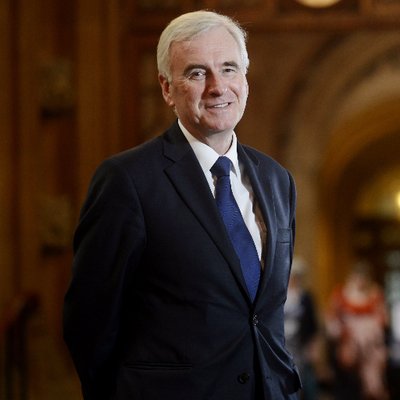

John McDonnell is shadow chancellor and MP for Hayes and Harlington.

More from LabourList

Josh Simons resigns as Cabinet Office minister amid investigation

‘After years of cuts, Labour’s local government settlement begins to put things right’

‘The Sherriff of Wild Westminster: what must change in elections bill’