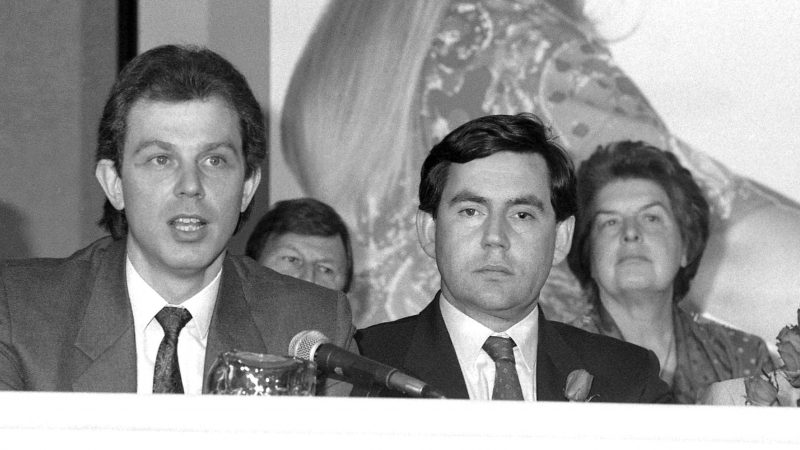

Here’s one for you: New Labour’s landslide victory in 1997 took place nearer in time to shillings and crowns being in circulation in 1970, than it did the present day. So, it should be no surprise that, despite Oasis heading out on tour or Labour PMs forming unlikely transatlantic alliances, the economy today is half the world away from that which Gordon Brown oversaw in the late-1990s.

And yet, and yet, the calls for this government to do a re-run of New Labour when it comes to tax and spend keep coming. Brown could afford to redistribute large sums, invest in every public service, and keep taxes low because demographic pressures were less acute and – crucially – because the economy was growing at a fair clip.

In stark contrast, this government has taken over an economy which has stagnated for over a decade; a tax burden already much higher than under Brown; and, turbo-charged by Liz Truss’s mini-budget, government borrowing costs that now top £100 billion a year.

The government can’t do everything right away

It’s these fundamentals that mean this government just can’t do everything right away. The Chancellor rightly prioritised spending on public service priorities, including the NHS and policing, and on setting fiscal rules which allowed a significant increase in borrowing for investment.

But, fiscal space is constrained. We exist not in the economic world as we’d like it to be, but in the harsh world of high interest rates and a large stock of government debt. Ultimately, without growth to bring in revenues the choice is simple: higher taxes or higher borrowing.

READ MORE: ‘If we ducked tough choices for growth, Britain’s spiral of decline would continue’

Higher taxes on everyday people are a non-starter. Our manifesto was clear, and we should stick to it. Some might say we should turn to wealth taxes to fund more spending. This forgets that we have already raised taxes on the wealthy: on speculators who have driven up the price of family farms, on private jet users, on non-doms and by changing some inheritance tax rules.

Proposals for revenue raisers which won’t just shift assets overseas and cost us all more or be politically toxic (I won’t stand for wealth tax reforms that lead to unfair increases in council tax in Barnet, for example), should be looked at carefully. But its just not credible to suggest the government isn’t already doing as much as it reasonably can on tax.

Bringing day-to-day government spending in line with tax revenues is reasonable

Higher borrowing, which would involve scrapping the fiscal rules, is even more of a bad idea. No surprises that this is the Tory choice. Fundamentally, bringing day-to-day government spending in line with tax revenues is a reasonable fiscal rule for the Chancellor to stick to. Scrapping this would only risk returning bond markets to their Liz Truss-style frenzy, making mortgage holders – and all of us – poorer again. Labour stability has delivered 3 cuts to interest rates already, we shouldn’t put that at risk.

The futility of scrapping fiscal rules to borrow more, only for most of the additional borrowing to go straight on debt interest should make the Conservatives and all those who want to return to Truss-land think again.

Ultimately, if we want more money for public services, the answer is simple: economic growth. That’s why the government has committed to £100 billion more capital investment this Parliament, why we are reforming planning to unleash a wave of building for the future, and why we are pushing regulators, pension funds and every economic actor to change the habits taught by gloomster-blocker Tory Chancellors, and instead turn their hand to getting the economy growing so every family can be better off.

There’s a big prize if we can do this: rising living standards and better public services. That this sometimes feels a stretch target is a reminder of just how deep a hole previous governments have put us in. But I’m confident this government’s ambition, and this country’s potential, will mean we can get back to the good old days once again.

For more from LabourList, subscribe to our daily newsletter roundup of all things Labour – and follow us on Bluesky, WhatsApp, Threads, X or Facebook .

- SHARE: If you have anything to share that we should be looking into or publishing about this story – or any other topic involving Labour– contact us (strictly anonymously if you wish) at [email protected].

- SUBSCRIBE: Sign up to LabourList’s morning email here for the best briefing on everything Labour, every weekday morning.

- DONATE: If you value our work, please chip in a few pounds a week and become one of our supporters, helping sustain and expand our coverage.

- PARTNER: If you or your organisation might be interested in partnering with us on sponsored events or projects, email [email protected].

- ADVERTISE: If your organisation would like to advertise or run sponsored pieces on LabourList‘s daily newsletter or website, contact our exclusive ad partners Total Politics at [email protected].

More from LabourList

Delivering in Government: your weekly round up of good news Labour stories

‘Outflanked on both sides: why Labour is losing touch with the economy’

‘Labour’s lesson from Denmark: immigration alone won’t save you’