The coronavirus crisis has not only shone a spotlight on the deep inequalities in our society – and their deadly consequences – but it has deepened them. As we come out of this pandemic, if we are to learn the lessons and build a fairer society, then we need to address decades of failing tax policy.

Since Margaret Thatcher, the Tory mantra has been that low taxes on the rich benefit everyone. But years of keeping taxes low for the very rich did not in fact boost economic growth, but instead allowed inequality to run out of control.

New research by LSE and King’s College London showed how reducing taxes on the rich leads to higher income inequality but does not have any significant effect on economic growth or unemployment. ‘Trickle-down’ economics has been a lie.

Tax is increasingly at the centre of the political debate. In the United States, Joe Biden is proposing to raise the corporation tax rate from 21% to 28%, increase income taxes on those earning over $400,000 and tax capital gains at the same rate as individuals’ income for incomes above $1m – all to fund a huge infrastructure programme.

Even the IMF’s head of fiscal affairs recently told The Financial Times that there should be increases in taxation from those who have made huge profits from the pandemic.

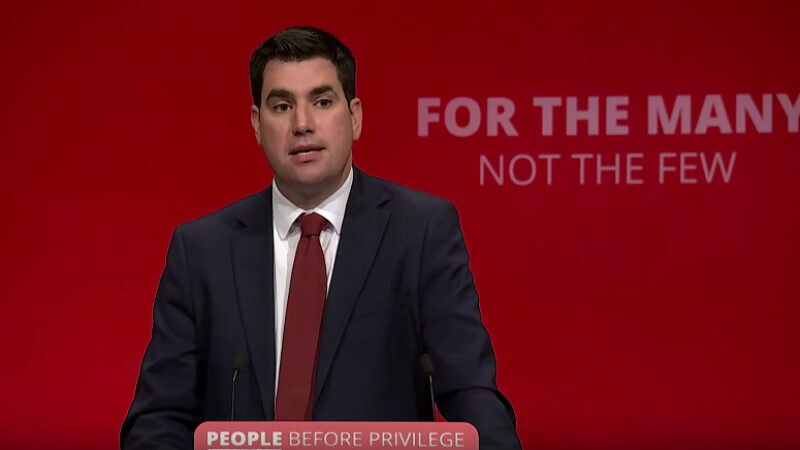

The Labour Party needs to lead this tax debate. That’s why I have submitted two amendments to the government’s finance bill being debated today. They call for a new 55% tax rate on all incomes above £200,000 per year and for a windfall tax on companies making super-profits from this crisis.

Higher taxes on the super-rich should not simply be about paying off the deficit. In fact, I believe borrowing to invest in a huge programme of public works, from high speed internet for all communities to a proper Green New Deal, and the strong economic growth this would generate is the best way to get the deficit down. Though of course progressive taxes can contribute to that.

These tax amendments are about encouraging a discussion on the kind of society we want to be when we come out of this crisis – for us, that must be a more equal, less divided and more inclusive society.

The amendment for a new 55% income tax rate would target those on very high incomes of over £200,000 per year. The current highest income tax rate is 45% for those earning above £150,000. Such an increase would affect less than 1% of the population, around 300,000 people, according to HMRC.

40 years ago, the average top income tax rate for the wealthy OECD member countries was 62%. The top US federal income tax rate was around 90% in the 1950s and 1960s and similar in the UK. Top income tax was even 60% under Thatcher. A decade ago, US economists Peter Diamond and Emmanuel Saez estimated that the revenue maximising top income tax rate was 73%.

The idea of a windfall tax on pandemic super profits is one that I raised at PMQs last December and that others including John McDonnell as well as academics, social justice campaigners and tax experts have been calling for. The Resolution Foundation has argued for such a windfall tax drawing on the “principles of solidarity and fair burden-sharing”.

Not only did Gordon Brown as Chancellor implement a one-off windfall tax on “the excess profits of the privatised utilities” in 1997, but as Andrew Fisher recently pointed out so did Tory Chancellor Rab Butler in his 1952 Budget. As Butler told the House of Commons when he announced the excess profits tax, “we are not prepared to see excessive profits being made”.

Of course, these are only some of the options for creating a more progressive tax system, which would be popular as well as help to build a fairer society. We need to be tackling tax avoidance so that Amazon and the like are not able to exploit tax loopholes, which appear deliberately drafted to allow mega-corporations to pay lower taxes. And of course capital gains should be taxed at the same rate as income.

Truly tackling the grotesque levels of inequality in our society also means we need to look at wealth taxes. Oxfam recently told the Treasury select committee that given high wealth inequality and the low contribution wealth taxes make to revenues, there was a need for higher taxing of those with very high wealth. The UK Wealth Tax Commission has called for a one-off wealth tax payable over a number of years, and Argentina recently implemented a wealth tax on its 12,000 richest people.

The Tories have attempted to capture the initiative on taxation with the first corporation tax rise since in nearly 50 years. As usual with the Tories, this is smoke and mirrors. There is a huge corporate tax giveaway coming over the next two years that will benefit the mega corporations, and they are making millions of the lowest-paid workers pay more income tax as well as higher council taxes. Nonetheless, it highlights the need for Labour to lead the tax debate by boldly making the case for a progressive tax system as part of delivering the fairer country we want to build.

More from LabourList

Lou Haigh to reveal ‘roadmap’ for public ownership of railways within first term

Rochdale Labour says brick thrown at candidate’s home with ‘f*** Labour’ note

‘Frank’s poverty mission lives on at his charity – but he’d scrap two-child cap’